Overturned Medical Debt Rule Will Impact Black Americans

Share

Explore Our Galleries

Breaking News!

Today's news and culture by Black and other reporters in the Black and mainstream media.

Ways to Support ABHM?

By Jennifer Porter-Gore, Word in Black

A federal judge reversed a rule that would have kept $49B in medical debt off of millions of people’s credit scores.

When a Biden-era consumer protection rule removed billions in medical debt from personal credit scores, fair-credit watchdogs cheered. The rule, they said, would be of particular benefit to Black Americans, whose credit scores are more likely to be weighed down by doctor or hospital bills than other racial groups.

This week, however, a federal judge in Texas overturned the rule the Consumer Financial Protection Bureau implemented in January. Judge Sean Jordan, a Trump appointee, ruled that the CFPB had usurped a power reserved for Congress.

Now, banks and other lenders can resume using information about unpaid hospital or medical bills when considering a credit or loan application. Experts say the boomerang will hamstring consumers applying for a mortgage, auto loan, or new credit card.

Meanwhile, the Trump Administration and DOGE implemented an executive order that has since gutted the CFPB and overturned several consumer protection rules.

Last year, an estimated 31 million Americans borrowed money to pay for healthcare costs. This includes 23% of Black adults — more than double the rate of white adults. Around 3 in 10 Black adults under age 50 borrowed money to pay medical bills, compared with just 14% of whites.

Allison Sesso, president and CEO of the nonprofit Undue Medical Debt, said the ruling will not only hurt consumers’ access to credit but also hinder their ability to find work. It could even keep them from seeking healthcare for fear of incurring more debt.

The original article explains how this change can hurt in multiple ways.

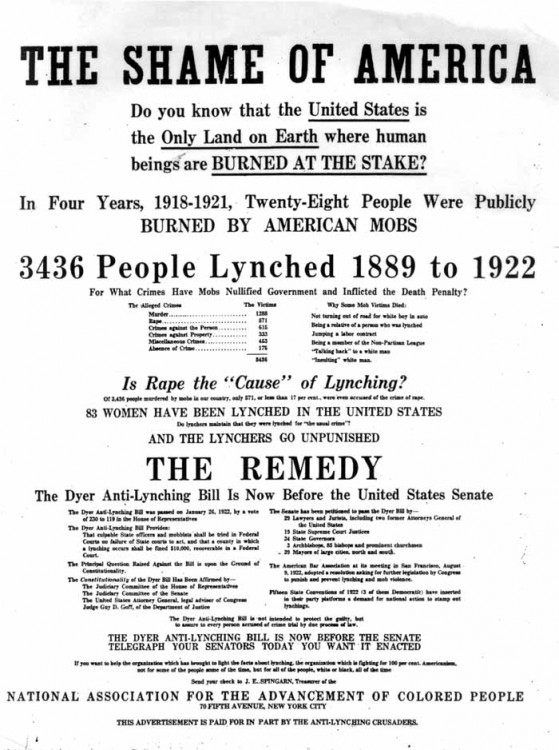

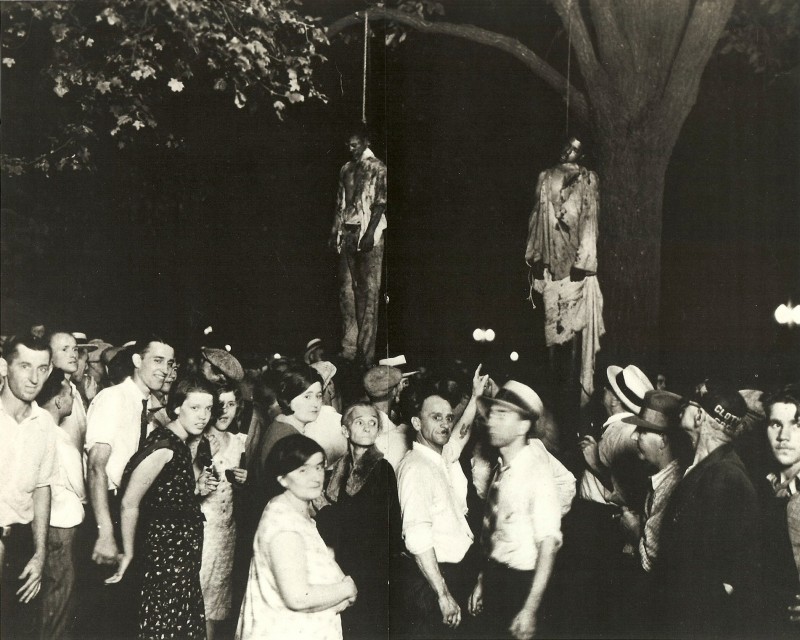

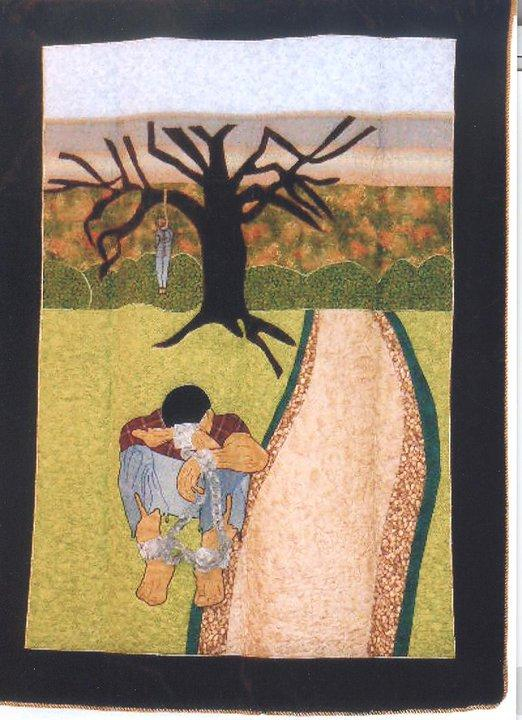

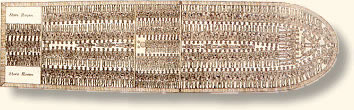

Black families already struggle financially, often as a result of redlining rules instituted during Jim Crow.

Comments Are Welcome

Note: We moderate submissions in order to create a space for meaningful dialogue, a space where museum visitors – adults and youth –– can exchange informed, thoughtful, and relevant comments that add value to our exhibits.

Racial slurs, personal attacks, obscenity, profanity, and SHOUTING do not meet the above standard. Such comments are posted in the exhibit Hateful Speech. Commercial promotions, impersonations, and incoherent comments likewise fail to meet our goals, so will not be posted. Submissions longer than 120 words will be shortened.

See our full Comments Policy here.